Medical Emergencies Can Drain Your Savings—Here’s How to Protect Yourself

Picture this: you’ve been saving up for a house, a car, or your children’s future education. Then, out of nowhere, a critical illness like cancer, a heart attack, or a stroke changes everything. Your financial goals are suddenly overshadowed by soaring medical bills, lost income, and everyday expenses.

Many Filipinos think their emergency fund or health insurance is enough to cover these costs. But what happens when expenses exceed what they can handle?

This is where critical illness insurance steps in—not just to protect your health but also to safeguard your finances. Unlike health insurance, which only reimburses medical bills, Oona Critical Illness Insurance provides a 100% lump-sum payout upon diagnosis. This means you can use the money for treatment, bills, or maintaining your lifestyle, giving you peace of mind during tough times.

Why Health Insurance and an Emergency Fund May Not Be Enough

Many people rely on PhilHealth, HMO plans, or personal savings to cover medical emergencies. However, these may not be enough when facing a serious illness.

1. Health Insurance vs Critical Illness Insurance: Limitations

Health insurance and HMOs often have limitations. Most HMO plans in the Philippines provide an annual benefit limit (ABL) of ₱100,000 to ₱300,000, which can quickly fall short when treating severe illnesses like cancer or heart disease—conditions that can cost millions

.

While PhilHealth can reduce treatment costs, it doesn’t cover everything. Many patients still find themselves paying out-of-pocket for medications, hospital stays, and specialized treatments.

2. Emergency Funds Can Be Wiped Out Quickly

Having an emergency fund is essential, but it’s not unlimited. A critical illness can lead to months (or even years) of lost income, making it harder to pay for:

Household bills and daily expenses

Ongoing treatments and medications

Specialist consultations and alternative therapies

Without a solid backup plan, you may have no choice but to take on loans, sell assets, or ask for financial help.

How Critical Illness Insurance Protects Your Savings

1. 100% Lump-Sum Cash Payout

Unlike health insurance, which only reimburses hospital bills, critical illness insurance provides a lump-sum payout upon diagnosis. With Oona, you get the full benefit amount upfront, up to ₱500,000 depending on your chosen coverage. This means you have the freedom to use the money however you need:

Pay for medical treatments not covered by insurance

Cover household expenses while you recover

Settle loans or mortgages

Fund alternative treatments or rehabilitation programs

2. Financial Stability During Recovery

A serious illness can force you to stop working for months—or even permanently. With critical illness coverage, the lump sum payout ensures that you and your family can still afford daily necessities like food, rent, tuition fees, and other living expenses.

3. Avoiding Debt and Asset Loss

Many Filipinos resort to borrowing money or selling properties to cover medical expenses. Critical illness insurance prevents this financial strain by providing immediate cash support, so you don’t have to drain your savings or take on expensive loans.

How Critical Illness Insurance Complements Your Health Insurance

Many Filipinos believe that PhilHealth or an HMO plan provides full coverage for medical expenses. While they offer vital support, they don’t cover the full financial burden of a critical illness. Here’s how critical illness insurance bridges the gap:

1. Health Insurance Pays for Medical Bills—But What About Everything Else?

Health insurance primarily covers hospitalization, doctor’s fees, and some medications—but what happens if you can’t work due to illness? You’ll still need to pay for:

Daily living expenses (rent, food, utilities)

Mortgage or car loan payments

Child’s tuition fees

Specialized care and alternative treatments

Oona Critical Illness Insurance offers a 100% lump-sum payout, allowing you to cover more than just medical bills—giving you the freedom to manage your finances during recovery.

2. No Worries About Benefit Limits and Exclusions

Most HMO plans have an Annual Benefit Limit (ABL) of ₱100,000 to ₱300,000. If your treatment costs exceed this, you’ll be left to pay the difference, out of pocket. With Oona, your lump-sum payout is guaranteed upon diagnosis, regardless of medical bills or hospital limits—giving you peace of mind.

3. Immediate Cash Support for Recovery

Recovering from a serious illness takes time. Even if your hospital expenses are covered by health insurance, you might not be able to work for months or even years. Oona’s lump-sum payout gives you financial breathing room to focus on recovery without worrying about lost income.

4. Freedom to Choose Treatments Not Covered by Your HMO

Some medical treatments, such as experimental drugs, special rehabilitation programs, or alternative therapies, may not be covered by traditional health insurance. With a lump sum payout from Oona, you have the financial flexibility to explore every possible treatment option for a full recovery.

5. Protects You from Future Rate Increases

If you develop a critical illness, your HMO provider may increase premiums or refuse to renew your policy. But with Oona Critical Illness Insurance, your payout is guaranteed as long as your policy is active—without worrying about rate hikes due to your health condition.

The Perfect Combination for Total Protection

When combined, these two types of coverage offer complete protection, shielding you and your family from the full financial impact of a critical illness.

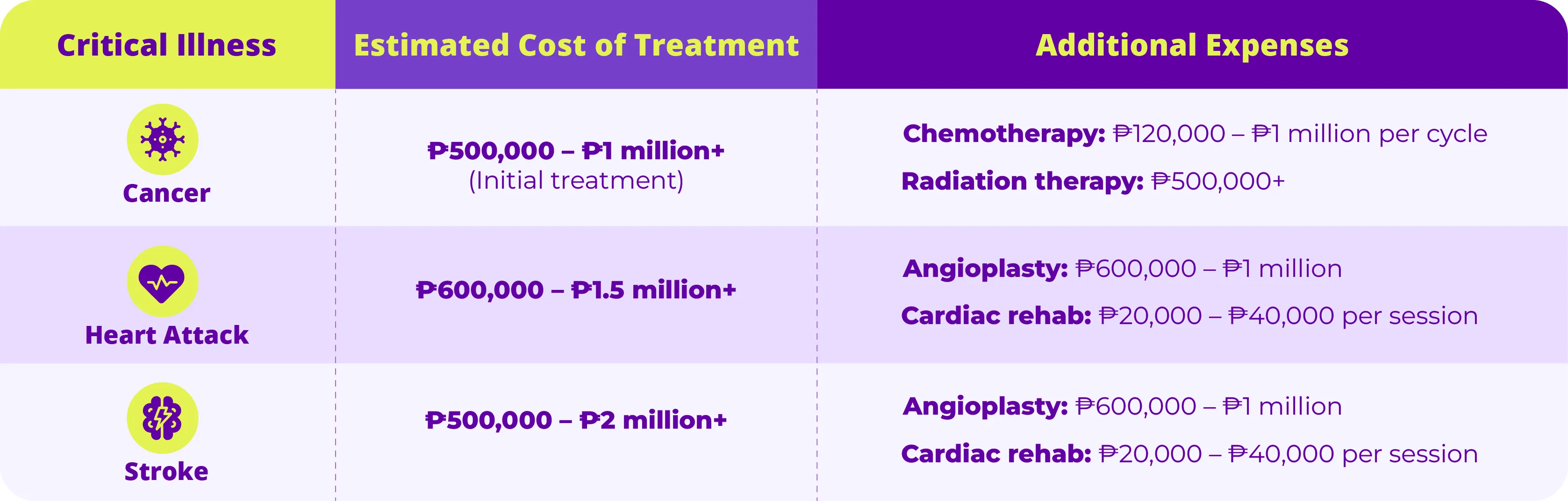

The Real Cost of Critical Illnesses in the Philippines

Most people focus on medical bills when thinking about the costs of illness, but the true financial burden of a critical illness goes far beyond that. It includes long-term treatments, medications, rehabilitation, and the loss of income if you’re unable to work.

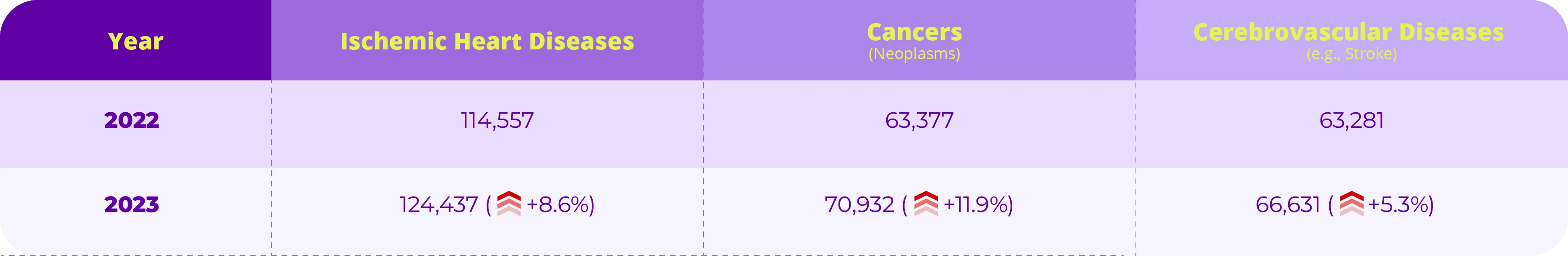

Rising Cases of Critical Illnesses (2022-2023)

The number of deaths from critical illnesses has surged in just one year, underscoring the growing health risks for Filipinos. With critical illness coverage, you can ensure that you and your family are financially prepared for these increasing challenges.