After the Accident: What “Total Loss” Means for Filipino Car Owners

24 Jun 2025

Overview

CTPL is not just any insurance, it's a mandatory coverage by the Land Transportation Office (LTO) for all vehicle owners in the Philippines.

LTO-accredited, with exceptionally easy-claims, Oona CTPL Insurance keeps you protected against accidents that cause injury, or worse, death to another person.

Don't let uncertainties dampen your road adventures. Drive with peace of mind, knowing that Oona has got your back. No fixers, no hassles—just a few simple steps and starting at an affordable price of only ₱290, and you're ready to hit the road confidently.

Product

We understand that choosing the right CTPL insurance in the Philippines goes beyond just meeting requirements; it's about securing your journey with confidence and reliability.

Explore these FAQs to learn more about it.

The Certificate of Cover is a vital part of the CTPL policy. It's the document needed by the Land Transportation Office (LTO) for processing the vehicle's certificate of registration, ensuring that it is legally registered for use.

No, CTPL does not cover property damage to a third-party's property. It only provides coverage for bodily injury or death of a third-party person.

VTPL has a fixed premium determined by the coverage limit, ranging from ₱190 to ₱3,000.

No Fault Indemnity means our company will cover your accident expenses of up to ₱15,000, regardless of who's at fault.

Yes. While Comprehensive Motor Insurance is optional when you register a vehicle in the Philippines, it is a legal mandate for vehicle owners to have a valid Compulsory Third Party Liability (CTPL) Insurance,. So driving without one can get you into trouble.

It's recommended to get Comprehensive Insurance with Acts of Nature coverage, especially in the Philippines where natural disasters can happen.

The Certificate of Cover (COC) is an important document in your CTPL insurance policy. When you buy CTPL insurance, you'll receive the COC, which is essential for processing requirements with the Land Transportation Office (LTO). While the COC serves as proof of insurance, it's not the same as the CTPL policy. Instead, it's a vital part of it.

The validity of CTPL Insurance depends on your vehicle's condition during the time of purchase. CTPL for new vehicles expire after three (3) years, while for non-brand new vehicles, their CTPL Insurance usually expires after a year. Upon expiry, you would need to renew your CTPL insurance every year.

It's insurance that covers the insured person against liability to any third party resulting from using the insured vehicle. CTPL covers only bodily injury and death of third parties, while VTPL also covers damage to their property.

Compulsory Third Party Liability Insurance or CTPL Insurance is a coverage that is required by law in the Philippines for all motor vehicles when registering with LTO. This insurance protects you against any legal responsibilities for injuries or death to others caused by using the insured vehicle.

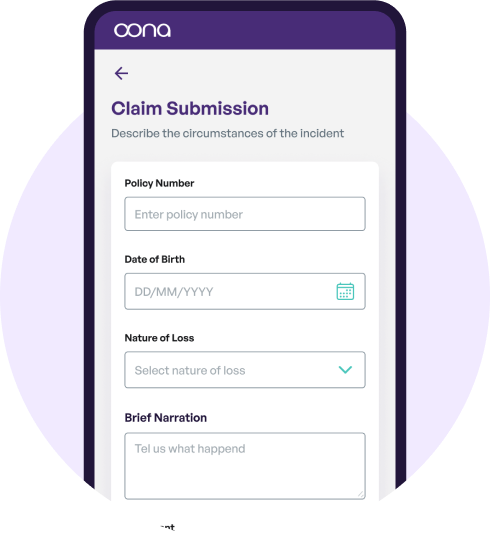

How to file a claim for your CTPL Insurance?

Prepare and collate all the required documents and claim details for submission. Click here to see the required documents.

Fill out the online claim form and upload the required documents online.

Make a Claim ----- Other Ways to File a Claim

You can also call our Claims Assistance Hotline (8am to 5pm, M-F) at:

Landline: (+632) 8876 4400

Smart: (0920) 918 6242

Globe: (0917) 581 7175

or email:

fnolclaims@oona-insurance.com.ph (for Motor and Personal Accident Claims) pcm_claims@oona-insurance.com.ph (for Non-motor claims)

For travel claims:

Outside the PH: (+00) 632 8459 4727

Within the PH: (02) 8459 4727

Email: travelassist@oona-insurance.com.ph

Claim result will be informed within 5 business days upon submissions of all required documents to Oona.