Car Insurance Philippines: Smart Guide to Save More

26 Nov 2025

Overview

CTPL is not just any insurance, it's a mandatory coverage by the Land Transportation Office (LTO) for all vehicle owners in the Philippines.

LTO-accredited, with exceptionally easy-claims, Oona CTPL Insurance keeps you protected against accidents that cause injury, or worse, death to another person.

Don't let uncertainties dampen your road adventures. Drive with peace of mind, knowing that Oona has got your back. No fixers, no hassles—just a few simple steps and starting at an affordable price of only ₱290, and you're ready to hit the road confidently.

Product

We understand that choosing the right CTPL insurance in the Philippines goes beyond just meeting requirements; it's about securing your journey with confidence and reliability.

Explore these FAQs to learn more about it.

The Certificate of Cover is a vital part of the CTPL policy. It's the document needed by the Land Transportation Office (LTO) for processing the vehicle's certificate of registration, ensuring that it is legally registered for use.

No, CTPL does not cover property damage to a third-party's property. It only provides coverage for bodily injury or death of a third-party person.

VTPL has a fixed premium determined by the coverage limit, ranging from ₱190 to ₱3,000.

No Fault Indemnity means our company will cover your accident expenses of up to ₱15,000, regardless of who's at fault.

Yes. While Comprehensive Motor Insurance is optional when you register a vehicle in the Philippines, it is a legal mandate for vehicle owners to have a valid Compulsory Third Party Liability (CTPL) Insurance,. So driving without one can get you into trouble.

It's recommended to get Comprehensive Insurance with Acts of Nature coverage, especially in the Philippines where natural disasters can happen.

The Certificate of Cover (COC) is an important document in your CTPL insurance policy. When you buy CTPL insurance, you'll receive the COC, which is essential for processing requirements with the Land Transportation Office (LTO). While the COC serves as proof of insurance, it's not the same as the CTPL policy. Instead, it's a vital part of it.

The validity of CTPL Insurance depends on your vehicle's condition during the time of purchase. CTPL for new vehicles expire after three (3) years, while for non-brand new vehicles, their CTPL Insurance usually expires after a year. Upon expiry, you would need to renew your CTPL insurance every year.

It's insurance that covers the insured person against liability to any third party resulting from using the insured vehicle. CTPL covers only bodily injury and death of third parties, while VTPL also covers damage to their property.

Compulsory Third Party Liability Insurance or CTPL Insurance is a coverage that is required by law in the Philippines for all motor vehicles when registering with LTO. This insurance protects you against any legal responsibilities for injuries or death to others caused by using the insured vehicle.

Yes, car insurance for one, is subject to Value-added Tax (VAT) and Local Government Tax, including fees for authentication and documentary stamp.

For death or permanent disability claims, it's up to ₱200,000. For other injuries, compensation follows what is set in the schedule of indemnities.

Yes, TPL (Third Party Liability) and CTPL (Compulsory Third Party Liability) are essentially the same. They both aim to protect against liabilities to third parties. However, in motorcar insurance, there are two types of TPL:

CTPL (Compulsory Third Party Liability): This insurance is mandated by the Land Transportation Office (LTO) for vehicle registration in many places. It usually covers up to ₱200,000 and is limited to injuries or death of third party persons involved in an accident with the insured vehicle.

VTPL (Voluntary Third Party Liability): This is optional insurance that offers more coverage than CTPL. It can cover from ₱500,000 to ₱1,000,000. VTPL includes both injury or death to third parties and damage to their property, offering broader protection similar to a comprehensive insurance policy.

In short, while TPL and CTPL are similar, CTPL is a specific type required for vehicle registration, and VTPL is an optional extension that provides more comprehensive coverage.

CTPL in the Philippines normally costs between ₱350 to ₱2,500 per year. For new vehicles, there's a three-year option costing between ₱1,800 to ₱4,500.

You can still drive the vehicle without comprehensive insurance, except for CTPL, which is required for car registration.

No, unless your vehicle is financed through a loan with a financing company, like a bank. Financing companies require insurance for vehicles under a loan term.

Yes, you need CTPL (Compulsory Third Party Liability) Insurance in the Philippines for legal vehicle registration with the LTO, even if you already have comprehensive motor insurance. CTPL is a must, while VTPL (Voluntary Third Party Liability) in comprehensive policies is optional.

TPL, or Third Party Liability insurance, covers injuries or damages to a third party caused by an accident arising from the use of the insured vehicle. It doesn't cover damage to the insured vehicle or injuries to its driver or passengers.

Comprehensive motor insurance offers broader coverage. It includes protection for the insured's vehicle, injuries to the driver, and injuries to passengers, which are not covered by TPL.

In summary, comprehensive motor insurance provides more extensive protection, covering both third-party liabilities and personal damages or injuries.

The Schedule of Indemnities is a chart that lists the possible compensation amounts for different types of injuries. It helps people understand how much they could potentially get from a claim.

How to file a claim for your CTPL Insurance?

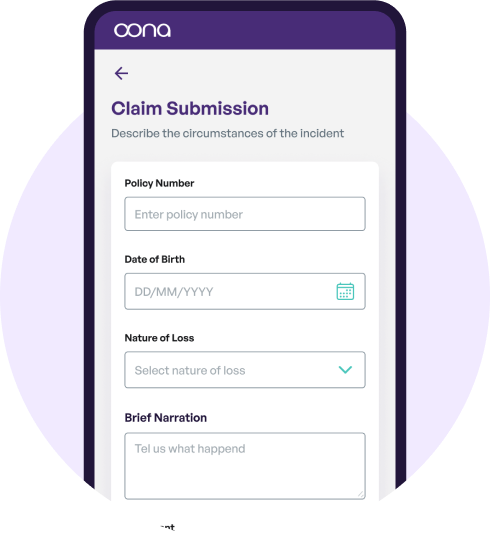

Prepare and collate all the required documents and claim details for submission. Click here to see the required documents.

Fill out the online claim form and upload the required documents online.

Make a Claim ----- Other Ways to File a Claim

You can also call our Claims Assistance Hotline (8am to 5pm, M-F) at:

Landline: (+632) 8876 4400

Smart: (0920) 918 6242

Globe: (0917) 581 7175

or email:

fnolclaims@oona-insurance.com.ph (for Motor and Personal Accident Claims) pcm_claims@oona-insurance.com.ph (for Non-motor claims)

For travel claims:

Outside the PH: (+00) 632 8459 4727

Within the PH: (02) 8459 4727

Email: operationsph@pacifico-assistance.com.ph

Claim result will be informed within 5 business days upon submissions of all required documents to Oona.